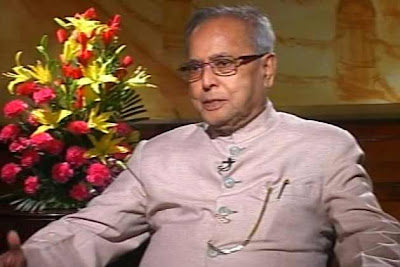

What should Pranab's Budget priorities be?

CNBC-TV18's special pre-budget show "Priceline" puts the spotlight on the country's top-of-the-line economists and policymakers on to find out their perspective of what the economy wants from the Budget 2011. The show is called Priceline because the economy today wants a halt to the relentless rise in prices.

The budget, as the foremost economic financial statement of the government, pushes interest rates up or down by the size of its deficit. If it spends more than it earns, it borrows heavily from banks, pushes up interest rates. It creates demand faster than the production of goods and thus, can also fan inflation. Nevertheless, in a few hours the budget will have to take into account the new realities on subsidies, on growth and on inflation.

So what should the government’s priorities and assumptions be? CNBC-TV18's Latha Venkatesh caught up with Arvind Panagariya, Jagdish Bhagwati professor of Indian critical economy at Columbia University, Dr Parthav Mukhopadhyay, Senior person at the centre for policy research, and Dr S Narayan, former finance secretary and currently teaching at the University of Singapore to find out their reading of the economy and expectations from Budget 2011.

Below is a verbatim transcript of the interview.

CNBC-TV18: S Narayan, let me start with you since you have had so much experience in government. According to you, what should be the prime goal of this budget?

Narayan: The prime objective of this budget is on the inflation front, give a measure of relief to the common man to be able to tackle the inflation. So, I do expect some income tax relief measures, some taxation relief measures for the common man, I think this is important. At the same time, there will be tightening on the fiscal deficits side, which can only happen through the tighter expenditure controls, closer monitoring of expenditure schemes, and perhaps a little bit of taxation, probably on the manufacturing and the services side.

CNBC-TV18: Would you say that the fiscal directly fueled inflation in the past 30 months, I have some numbers. The government borrowing from the period of October 2008, up until March 31st, this year, 2011 is Rs 9.2 trillion. Net borrowing, not gross, not to pay back the old debt. In the previous 10 years, from 1999-2008, September 30th, the government borrowing is more like Rs 8.9 trillions. So in 30 months, borrowing has been so much more, equal to the past 10 years. Don’t you think this is directly inflationary?

Panagariya: I think there is no question that we need to rein in, expenditures of the government, but in so far as inflation is concerned, at least in my thinking, it has a lot more to do with monitory policy. What the expenditures, what the government incurs do is that it takes out the savings.

Savings are to be converted in investments, but in so far as large part of their savings, actually is taken out by the government in the form of these borrowings, with these very large numbers that you have quoted, are savings leftover for the investors actually declining? There is an implication for interest rates and so forth as well, but in assessing inflation we should not forget the external factors that have been out there.

The two things are I should say one, because for some years we have had no inflation of 5-6 per cent or even lower than that. We have kind of become used to that kind of number but traditionally 8-9-10 per cent inflation in the 80s and the 90s had been out there almost on a consistent basis. So, I kind of react a little less to that. I would rely on the Reserve Bank, the central for this.

CNBC-Tv18: Actually this 8-9 per cent is a bit scary if that becomes a habitual inflation in the years to come. It was only when we could rein in inflation to much lower levels that we have seen growth growing from that old 3.5 per cent to 5 per cent and 6 per cent in the 1990’s to 8-9 per cent in the current decade. It has also meant this lowering of inflation and inflation expectations has pulled up the savings rate from 20 per cent levels or sub 20 per cent levels in the 1990’s to 23 per cent and eventually to 33 per cent currently, wouldn’t all that be jeopardized if inflation became habitually at 7-8 per cent?

Panagariya: We grew at rates of about 6 per cent steadily during the 1990’s and even during the low inflation rates we were still growing at 5-6 per cent. 8-9 per cent growth rate shift happened in 2003-2004 and we have steadily stayed there in spite of the fact that the last two years inflation has been much higher, actually not 8-9 per cent but it had gone into double digits. I think double digit is a much bigger concern. The real concern with inflation currently is the food prices because those directly impact most of the poor people and this is why this is the part of the inflation the government ought to try to address which it has not done adequately because it had made a big mess of the public distribution system.

CNBC-TV18: Would you hold the fiscal responsible for inflation and two what should be the first goal of this budget?

Mukhopadhyay: First I think the Prime Minister answer during the interaction that he had, that there was in some sense almost conscious policy over the last couple of years since the financial crisis hit to prioritize and maintain growth even at the cost of some inflation. So in a sense and what you have seen as a result of this large fiscal push is basically the ability to keep growth at the current levels that you have.

So basically the trade off here is across two kinds of expectations, one is inflation expectations, the other is growth expectations both of them are going to feed into the kind of investment that people are going to make because they will make investment in anticipation of both these things.

So the judgment call that the government seems to have taken is that its better to make sure that your growth expectations are anchored at the 8-10 per cent kind of band rather than let that slip and hope that private investments sort of stays anchored on that stuff and keeps investing, so that the government can then slowly edge itself out.

That hasn’t really happened much because, while Arvind says that the fiscal deficit does take away savings and that’s true. But if you look at the amount of money that’s there with the banks right now, the banks are over invested in government securities which means essentially they have not been able to find investment opportunities that they can actually push their money in.

The ability of the government to withdraw from the system essentially depends on the private sector coming in. If you did see the private sector come in and this is why I mentioned this stuff on investment, if there was a stronger feeling that private sector was coming in, I think the government would have been able to exit much faster that’s the first thing.

Secondly on a variety of subsidies, yes, I think we need a whole bunch of work especially on the fertilizer subsidies, I think that’s a huge part of the story and of course on the fuel subsidies. The current approach that essentially against it.

Diesel is something that is not good for the system as a whole and you don’t particularly want to keep inflation at these levels because if you anchor inflation, what worries you is not what the current inflation level is but if it stays there for some time and actual inflation expectations actually stay anchored at a higher level then your life becomes a lot more difficult and the RBI has to do some serious belt tightening to be able to get inflation expectations down again.

So, largely all three of them are essentially a set of expectations including growth expectations, inflation expectations and fundamentally based on that is the private sector going to come in and allow the government to get out of it.

CNBC-TV18: If deficit control is indeed a priority goal, then how does one trim the expenditure? Given your stint in the finance ministry, is it possible to say handout a 5-10 per cent expenditure cut for all ministries? Does it work that way at all?

No comments: